Understanding the probate process in Alabama can be a daunting task for those unfamiliar with the process. Knowing the ins and outs of selling a house in probate is essential to completing the sale smoothly.

The first step is to determine if probate is necessary, as it may not be required if there is a will or if the estate qualifies for an expedited process. Depending on the situation, you may need to file a petition with the court and open an estate account.

Once that is complete, you must identify and notify any heirs, creditors or other interested parties along with publishing notice of intent. You will then need to receive approval from all involved parties before marketing and listing the property for sale.

As part of this process, you may also need to obtain appraisals and prepare inventories of assets for review. The final steps are closing on the property and distributing proceeds according to applicable laws and legal documents.

By following these steps, you can ensure that your probate sale goes as smoothly as possible.

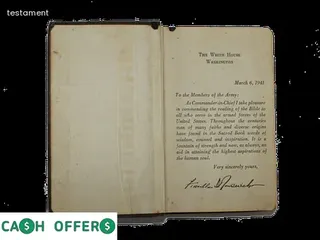

In Alabama, the probate process is regulated by state law. Before a property can be sold in probate, the executor of the estate must obtain Letters of Testamentary from the court.

This document gives the executor authority to act on behalf of the deceased’s estate and allows them to legally transfer title of the property. Additionally, an executor must provide a list of all creditors to whom money is owed and pay off any outstanding debts before selling a home in probate.

The Alabama Probate Code also requires that notice be given to all interested parties at least thirty days prior to listing a house for sale. Finally, any proceeds from the sale must be distributed according to Alabama law and according to any instructions outlined in a will or trust.

Understanding these requirements and regulations can help ensure that the process of selling a house in probate goes smoothly and quickly.

In Alabama, the executor of an estate has many rights and responsibilities when it comes to selling a house in probate. It is important for executors to understand these rights and responsibilities in order to ensure that the process of selling a home in probate is done legally and efficiently.

Under Alabama law, the executor has the right to make all decisions related to the sale of the property including setting the price, selecting a real estate agent, negotiating offers, and making repairs as needed. The executor also has certain obligations such as ensuring that all debts are paid out of the proceeds from the sale and distributing any remaining funds according to state law.

Executors should also be aware of their fiduciary duties which include handling all transactions with honesty and integrity so that they are acting in good faith on behalf of those named in the will or trust. Understanding these rights and responsibilities will help executors navigate through the complicated process of selling a house in probate in Alabama.

When a person dies in Alabama, their estate must be settled through the probate process. This process can be lengthy and expensive, but there are ways to avoid it altogether.

Estate planning is an important step for any Alabama resident, as it allows them to plan for what will happen with their assets after death. Through proper estate planning, assets can be transferred directly to designated beneficiaries without going through probate court.

Doing so allows the estate to skip the lengthy and costly process of probate and pass along assets without delay. Additionally, a well-crafted estate plan can help ensure that all of the deceased's wishes are fulfilled in accordance with state laws.

It is important to work with an experienced attorney when creating an estate plan to ensure that all legalities are handled properly and that the deceased's wishes are respected.

Establishing a will and trust is one of the most effective ways to avoid the probate listing process when it comes to selling a house in Alabama. A well-crafted estate plan, which includes both a will and trust, can help speed up the process of transferring ownership of a property after death.

A will designates how assets are distributed upon death, while a trust outlines who should receive the property as well as any conditions that may be attached. Setting up an Alabama will or trust also allows for more control over who inherits the property, since it is overseen by an executor or trustee rather than the court.

Additionally, establishing a will and trust before death eliminates many of the fees associated with probate proceedings such as court costs, attorney's fees, and executor's commission. Moreover, when you create an estate plan that includes both wills and trusts, you can ensure that your wishes are honored regarding how your assets are distributed after you pass away.

Navigating the Probate Court System in Alabama can be an intimidating process for those unfamiliar with the legal requirements. Understanding The Probate Listing Process In Alabama: A Guide To Selling A House In Probate is a helpful resource that provides guidance on how to go about selling property in probate.

This article will take you through the key steps, from filing an application for probate and gathering necessary documents, to listing your property with a real estate agent and ultimately closing the sale. It also covers topics such as determining the executor’s authority, selecting an attorney to handle probate, and preparing a detailed inventory of assets to be sold.

Additionally, you will learn how to determine if there are any liens or outstanding debts against the property that must be paid before it can be sold. Finally, you will gain insights into other important matters such as taxes, fees and title insurance.

With this knowledge in hand, you can confidently move forward with selling your home in probate while avoiding costly mistakes along the way.

In Alabama, the executor of an estate is entitled to receive compensation for their services. Calculating the amount of compensation can be a complex process, as it depends on several factors such as the size and complexity of the estate, time spent administering the estate, and any other special duties that the executor has been responsible for.

The state of Alabama has a guideline for calculating compensation, which includes taking into account both statutory fees and reasonable expenses incurred during the probate listing process. It is important to note that any fees due must be approved by a judge before being paid out to ensure accuracy and fairness.

Additionally, if there are multiple beneficiaries or heirs from whom commissions are due, they should all agree on how much each one should receive before it is disbursed. By understanding these guidelines and working together with all involved parties, you can ensure that everyone receives their rightful share in an efficient manner when selling a house in probate in Alabama.

In Alabama, the probate process has a set timeline that must be followed to settle an estate. Depending on the situation, it typically takes six to eight months for a will to go through probate, though this timeframe may vary if there are issues with the validity of the will or any disputes between heirs.

After submitting documents and filing fees, an executor is appointed by the court and they will then distribute assets according to the terms of the will. The executor may need to obtain court approval for some transactions and they are required to keep all beneficiaries informed throughout the process.

They must also file an inventory listing all assets owned by the deceased and pay off any debts owed from those assets. If there are no disputes, final settlement of an estate can be completed within a few months after all paperwork is filed with the court.

In Alabama, some estates may not require probate proceedings when selling a house. These typically include those with small estates worth less than $25,000 and no real estate, or estates with real estate in which the deceased has named a beneficiary on the deed.

In these cases, the executor of the estate can transfer ownership directly to the beneficiary following all necessary procedures without having to go through probate court. This makes for an easier process and can help save time and money for family members who are handling the sale of a home in probate.

Additionally, if there is no will present at all, this could be considered an intestate estate and can also avoid probate proceedings as long as certain requirements are met. The requirements are specific to Alabama law and must be carefully reviewed to determine whether they apply to any particular situation.

When it comes to selling a house in probate in Alabama, the process can become more complicated if there is no will. In this case, the estate is considered intestate, and so Alabama’s laws of intestacy apply.

This means that any inheritance must be divided among the decedent’s closest relatives, based on a predetermined order of succession and depending on whether or not the decedent had living children or other heirs at the time of death. The county probate court must determine who is entitled to what share of the estate, including real estate and personal property.

Before any distribution can take place, an administrator may need to be appointed by the court to oversee the sale of any real estate included in the probate estate. The administrator has certain legal powers such as authority to sell real estate and to make payments or distributions from proceeds of sale according to state law.

During this process, creditors may also present claims against assets within the estate before they are distributed. Once all claims have been settled and all taxes paid, then a distribution can take place according to intestate succession laws.

When it comes to understanding the probate listing process in Alabama, there are a number of legal resources available to help guide you through selling a house in probate. Understanding the law surrounding estates and probate can be complicated, so it is important to seek advice from an experienced lawyer.

In Alabama, estate law is governed by the Alabama Probate Code, which outlines the process for filing a will and administering an estate. The Code also sets out rules regarding the appointment of executors and guardians, as well as how assets will be distributed among heirs.

Additionally, there are numerous other resources available such as books, online guides, or seminars that can provide helpful information on understanding the probate process in Alabama. It is important to contact an attorney who is knowledgeable about estate planning and probate laws in your state for any questions you may have about this complex legal process.

The probate listing process in Alabama is often a complex and time-consuming process, and understanding the debts, taxes, and assets involved is critical to navigating it successfully. When an individual dies without a will, or intestate, their estate must go through probate.

During this process, all of the deceased's assets are identified and appraised. Then any outstanding debts must be paid off with those assets.

Next, any applicable taxes must be paid before the remaining assets can be distributed to beneficiaries. Knowing what debts and taxes are owed by the estate is essential for all parties involved in selling a house in probate in Alabama.

Additionally, understanding what assets are part of the deceased's estate is key to ensuring that those assets are properly managed throughout the probate process. The more informed each party is about their rights and obligations under Alabama law, the smoother the process of selling a house in probate will be for everyone involved.

The probate process in Alabama can differ from other states, making it important for sellers to understand the unique aspects of selling a house in probate. Understanding the laws and regulations surrounding the process is essential to ensuring that the sale goes smoothly.

In Alabama, the executor or administrator of an estate must be appointed by either a court or a will before they start to administer any assets. These assets must then be listed and appraised with the court so that they can be inventoried and distributed according to state law.

Additionally, all creditors must be paid before any assets can be distributed to beneficiaries. The executor must also provide notice of the probate listing to all interested parties, such as creditors and heirs.

Furthermore, certain legal documents may need to be filed with the court - such as tax returns - which must also comply with Alabama's probate listing requirements. Finally, once all of these steps have been completed, a hearing will take place in order to approve or deny an application for distribution of assets from an estate.

With these unique aspects in mind, it is important for potential sellers in Alabama to understand what is required when selling a house in probate.

When selling a house in probate in Alabama, it is important to understand the deadlines associated with filing documents with the court and finalizing estate matters. The executor of the estate must file an inventory of assets and debts within ninety days of being appointed, as well as a schedule of assets and liabilities within nine months.

Within twelve months of appointment, the executor must file a petition for final settlement in order to be discharged from their duties. The court will provide notice to creditors who will have three months to file claims for unpaid debt against the estate.

If there are no objections, the executor can submit a final accounting which must be approved by the court before distributing any remaining assets or closing out accounts. It is essential that these deadlines are met in order for the probate process to move forward efficiently; failure to do so could result in delays or additional costs.

When administering a probate estate in Alabama, both real and personal property can be distributed to beneficiaries. Real property includes land, buildings, and other tangible assets that are connected to the land.

On the other hand, personal property includes intangible assets such as stocks, bonds, money from bank accounts, furniture, jewelry and other items of value. The distribution of these assets is usually determined by the decedent's will or state law if there is no will.

When distributing real property during probate administration in Alabama, beneficiaries may receive direct distributions or distributions through a sale of the real estate. Direct distributions refer to transferring title directly to the beneficiary without selling the asset.

If a sale is necessary for distribution purposes, then it must be done according to Alabama law which requires notice to all interested parties before any sale can take place. Similarly, when distributing personal property during probate administration in Alabama beneficiaries may receive direct distributions or distributions through an auction or sale of personal property items if necessary.

In Alabama, individuals who are named as the executor of a deceased person's estate may be able to take advantage of certain small estate exemptions from formal administration procedures. This can lead to a much shorter timeline for selling a house in probate.

The state has established specific criteria for these exemptions, and it is important for an executor to understand what constitutes a small estate before determining whether or not they qualify. Generally speaking, if the total value of all assets owned by the deceased is under $50,000 and there are no debts owed against that value, then an executor may be able to skip certain formalities such as obtaining Letters Testamentary or seeking court approval before selling the property.

It should also be noted that if any part of the estate exceeds this threshold, then formal administration must take place. In order to ensure compliance with the law and avoid potential liability issues down the line, it is wise for anyone considering selling a house in probate in Alabama to consult with an attorney beforehand.

When a will is contested in Alabama, the respondent must file objections to an estate plan within 60 days of being notified of the will. Objections can be made for a variety of reasons, such as a lack of mental capacity or undue influence, and must be supported by evidence.

The court will then assess whether the objections have merit and, if so, appoint someone to represent the interests of all parties involved. When contesting a will, it is important to have legal representation in order to understand your rights and navigate the probate process.

Additionally, all parties must provide detailed financial information in order for the court to make an informed decision. In some cases, this may include filing taxes or submitting documents related to any assets owned by the deceased.

During this time it is also important to consider any changes that may need to be made to ensure that the deceased's wishes are carried out properly.

When it comes to understanding the probate listing process in Alabama, an attorney can play a crucial role in administering an estate. An experienced attorney can provide guidance on the legal requirements of the probate court and ensure that all documents are filed correctly and in a timely manner.

They will also be able to advise on how to value the estate and answer any questions you may have about selling a house in probate. Attorneys can help with the preparation of required forms and filings, as well as inform family members of their obligations and rights related to the estate.

Furthermore, they can help with the negotiation of creditor claims, real estate transactions, division of assets among beneficiaries, and other matters such as taxes or insurance. Overall, hiring an experienced attorney is recommended when dealing with complex probate situations and is often essential for those looking to sell a house in probate.

The probate listing process in Alabama is a complicated one that requires knowledge of legal and financial procedures. When an estate is declared bankrupt during the administration process, the executor of the estate must handle bankruptcy proceedings in order to pay off creditors and distribute assets to beneficiaries.

In Alabama, the executor will be required to file a petition with the court outlining the details of their bankruptcy plan. This document must include complete information on all creditors, assets, liabilities, and any other financial matters related to the deceased's estate.

Once approved by the court, a trustee will be appointed to manage and oversee all aspects of bankruptcy administration for the estate. The trustee is responsible for ensuring that all debts are paid in full and that creditors receive their due payments according to law.

It is important to note that even though an estate may be declared bankrupt during probate listing in Alabama, it does not necessarily mean that all assets must be liquidated or sold; there may be other solutions available depending on individual circumstances.

When dealing with the probate listing process in Alabama, it is important to understand the multi-state issues that may arise if a decedent’s estate spans multiple states. In some cases, the probate process can be complicated and time-consuming because assets must pass through more than one court system.

This can mean having to hire multiple attorneys or administrators who are familiar with each state’s laws and procedures. Additionally, any debts owed by the decedent must also be paid in each of the states where assets were held.

It is therefore essential for those involved in selling a house in probate to ensure they are aware of all applicable laws and regulations when dealing with a multi-state estate, as this could significantly impact how long it takes to complete the sale of the house. Furthermore, meeting deadlines imposed by each state can be difficult due to different timelines for filing paperwork and payment of taxes.

It is important for those selling a house in probate to keep track of all documents related to the estate and make sure they are filed on time so that there are no delays in closing on the property.

Yes, a house must go through probate in Alabama. Probate is the legal process of transferring ownership of assets from the deceased to their heirs.

In order to sell a house in probate in Alabama, the executor or administrator of the estate must obtain a court order authorizing the sale. The probate listing process can be complicated and time consuming, but it is important to understand all of the steps involved.

First, the executor or administrator must file an application with the court requesting permission to sell the property. Once this step is complete, they will need to hire an appraiser to assess the market value of the home and advertise it for sale.

Potential buyers can then submit offers and bids on the property until one is accepted by the executor or administrator. Afterward, closing documents will need to be prepared and a title search conducted before finalizing the sale.

Understanding all of these steps helps ensure that selling a house in probate in Alabama goes as smoothly as possible.

Probate is a legal process in Alabama that determines the validity of a deceased person's will. The probate court oversees the administration of the estate, including any debts that must be paid and assets to be distributed.

In order for a will to be accepted by the court, it must be signed by two witnesses and filed with the probate court in the county where the deceased lived at the time of death. The probate process can take several months or even years to complete and includes various steps such as inventorying assets, paying taxes and creditors, distributing assets according to the will, and finally closing the estate.

During this time period, selling a house in probate may become necessary due to financial hardship or other reasons. For those unfamiliar with selling a house in probate, understanding the listing process can help make it easier.

The Probate Listing process in Alabama is an important step for anyone looking to sell a house in probate. The length of time that an estate remains in probate will vary depending on the complexity of the case.

Generally, the time frame can range from six months to two years. In some cases, it may even take longer.

To ensure that all parties are properly informed, Alabama state law requires that the court provide notice to all interested parties at least 30 days prior to the court's decision on whether or not to grant probate. This is necessary so that all interested parties are aware of their rights and responsibilities related to the estate.

Once granted, the executor is responsible for administering and distributing assets according to the terms outlined in the will or other documents associated with probate. The process usually takes several months, but it can take up to two years if there are disputes over assets or other disagreements among heirs or beneficiaries.

It is important for potential buyers and sellers alike to understand how long an estate remains in probate before entering into any transaction involving a property in probate.

In Alabama, any real estate owned by a deceased person requires probate to transfer ownership. Probate is the legal process of proving a will as valid in court and settling the deceased person's estate.

Real estate is considered part of the estate, and must go through probate to be transferred to a new owner. The probate listing process in Alabama involves filing documents with the court that officially begins the probate process for the property.

Once this is done, a notice of hearing will be published in the local paper, giving creditors an opportunity to claim any debts owed by the deceased. Following this period, there will be an Order of Probate issued by the court that names an executor or administrator responsible for handling all further transactions regarding the property.

This order also gives permission to sell or transfer it as desired.