Navigating the estate administration process in Maryland can be a difficult and complex process. It requires knowledge of state laws, court proceedings and legal forms.

This comprehensive guide will provide an introduction to the steps involved in administering an estate in Maryland. From understanding the applicable state laws to filing the necessary paperwork, this guide will walk you through each step of the process.

It will also offer advice on how to handle different types of estates, such as those with multiple heirs or those with complicated tax situations. Finally, it will provide information on where to find help if needed.

Understanding the estate administration process is key to ensuring that all legal obligations are met, so that beneficiaries receive their rightful inheritance.

Navigating the estate administration process in Maryland can be complex and overwhelming. Understanding the various steps involved is key to carrying out a successful probate process.

Generally, the probate process involves collecting the decedent's assets, paying creditors and taxes, and distributing the remaining assets to beneficiaries. An executor is appointed by the court to oversee this process, or if none are appointed, then a personal representative may be designated by will.

The executor is responsible for gathering all relevant documents and obtaining a court order for probate. Then they must locate and inventory all assets owned by the decedent at time of death, including real estate deeds, bank accounts, investments, and other items of value.

Creditors must also be notified of death so any outstanding debts can be settled before assets are distributed to beneficiaries. Taxes must also be paid before final distribution of assets can occur; depending on how long it takes to complete all necessary paperwork and pay off debts, this process may take several months or even years.

It is important to understand the legal requirements associated with each step of the estate administration process in Maryland in order ensure a smooth probate process.

The Maryland estate administration process can be complex and difficult to navigate. One of the most important steps in this process is obtaining Letters of Administration, which grants an individual or group the ability to act as the fiduciary for a deceased's estate.

In order to receive these letters, there are certain requirements that must be met. First and foremost, it is necessary to provide proof of death via an official document such as a death certificate.

Additionally, individuals will need to provide evidence that they have been named as executor in the decedent's will, or else prove their relationship with the decedent if they are not named as executor. Lastly, any individual applying for Letters of Administration must also provide evidence that they are eligible according to Maryland state law; examples include being over 18 years old and having no criminal record.

These documents must then be submitted to a local Maryland probate court so that legal permission can be granted. It is essential for anyone navigating the Maryland estate administration process to understand all of these requirements before attempting to obtain Letters of Administration.

Navigating the Maryland estate administration process can be daunting, but exploring the benefits of letters of administration can make the task easier. Letters of administration are an important document issued by the court that proves a person has been appointed to administer an estate and act as its representative.

This document is necessary to gain access to financial accounts, transfer title on properties, and other tasks related to settling an estate. The main benefit of having a letter of administration is that it provides protection for both parties involved in the process.

The administrator will be able to exercise their authority knowing their actions will be backed by the power of the court. At the same time, creditors and beneficiaries will have peace of mind knowing they are dealing with an authorized representative of the deceased's estate.

Obtaining letters of administration also streamlines many aspects of the estate administration process, such as providing access to bank accounts or transferring title on real property. Without this document, completing these tasks can be time-consuming and complicated.

In summary, obtaining letters of administration is an important step in navigating Maryland's estate administration process that offers many tangible benefits for all parties involved.

When navigating the Maryland estate administration process, one of the most important aspects to consider is whether to use a sole proprietorship or a single member LLC. A sole proprietorship is an unincorporated business that is owned and operated by one individual.

It offers simplicity but also carries certain risks and liabilities for the owner. On the other hand, a single-member LLC offers limited liability protection for its owner, meaning that their personal assets are not at risk should their business be sued or incur debt.

While filing taxes can be more complicated with an LLC, it can also provide additional tax deductions. It's important to assess your situation and decide which entity type best suits your needs in order to ensure a smooth estate administration process in Maryland.

Downloading an eBook from Peoples-Law.org is a great way to further your knowledge of navigating the Maryland estate administration process.

The comprehensive guide provides valuable insight and tips on how to manage the time consuming and complex task of administering someone’s estate. You can learn about the process of filing for probate, its timeline, and procedures, as well as understanding the roles and requirements of a personal representative in accordance with Maryland law.

It also covers topics such as handling debts of the deceased, distribution of assets, filing taxes, closing accounts, resolving disputes, and more. With an easy-to-understand format and helpful resources included, you will be able to understand all aspects of this important process.

Downloading this eBook is a great way to gain useful information and make managing the estate administration easier than ever before.

Navigating the Maryland estate administration process can be a daunting task for even the most experienced executor or administrator. It is important to be aware of common mistakes that can occur when administering an estate in Maryland, so that you are able to avoid them and ensure a smooth transition.

One of the most common mistakes made while administering an estate is not properly identifying all assets and liabilities associated with it. This can lead to missing documents, omitting certain creditors, and other oversights that could cause complications down the road.

Additionally, failing to abide by state laws regarding taxes and probate processes can result in significant financial penalties. It's essential to understand the Maryland estate administration rules before beginning the process, so as to avoid any potential missteps.

Finally, it is important to keep clear records throughout the entire process, including any fees and expenses paid out along with copies of documents related to the case such as wills or deeds. Keeping thorough documentation will help protect you from liability should any issues arise during administration of an estate in Maryland.

When it comes to navigating the Maryland estate administration process, a qualified attorney can provide invaluable advice and guidance in understanding the legal complexities. Seeking out an experienced lawyer is the best way to ensure that all of your business bookkeeping needs are met during this process.

An attorney can help you understand the requirements for filing wills, paying taxes, and other paperwork associated with estate administration. They can also advise you on how to keep accurate records and track financial transactions for your small business.

By consulting with a knowledgeable lawyer about your bookkeeping needs, you can ensure that all of your financial paperwork is handled properly and you have all of the necessary documents for estate administration in Maryland.

Becoming an administrator of an estate in Maryland is a process that requires careful navigation. It involves gathering required documents, filing paperwork with the court, and attending to the tasks necessary to settle the estate.

To begin, you will need to fill out an Application for Appointment of Personal Representative form and submit it to the court. Along with this application, you will need to provide a list of creditors, tax returns, and other financial information relating to the estate.

In addition, you must also submit a copy of the death certificate and proof that all heirs have been notified of your appointment as Personal Representative. Once these documents are submitted and approved by the court, you will be appointed as Administrator of an Estate.

As Administrator you are responsible for managing all assets belonging to the estate during probate. This includes overseeing any real-estate transactions or investments, collecting debts owed to the estate, and distributing funds and assets according to Maryland law.

Additionally, you may be asked by the court to provide financial records or other reports related to your duties as Administrator. Following all steps outlined in state law and guidelines will ensure that everything is handled correctly when navigating through this process.

Navigating the Maryland estate administration process can be complex and intimidating. It is important to know that there are different types of estate administration available in the state, each with its own unique set of regulations and processes.

Depending on the size and complexity of the estate, different procedures must be followed. For example, a Small Estate Affidavit can be used when an individual has passed away with only minimal assets such as bank accounts or real property, and no Will or Trust.

This form is intended to expedite the transfer of those assets without requiring court supervision. On the other hand, any larger estates will require formal probate proceedings which are overseen by a court-appointed personal representative who is responsible for collecting all assets and distributing them according to the Will or Trust provisions.

Additionally, if an individual dies without a Will or Trust in place, a process called "intestate succession" may be used to distribute assets according to Maryland's laws of intestacy. Finally, if an individual requires assistance managing their finances prior to death due to incapacity, they may opt for conservatorship which appoints someone else to manage those financial affairs on their behalf.

Understanding these different types of estate administration options available in Maryland can help individuals prepare for their future and ensure that their loved ones are taken care of after they pass away.

Navigating the Maryland estate administration process can be complex and overwhelming, but having a comprehensive guide helps simplify the process. One key element of this process is answering questions regarding who can be named as the administrator of an estate.

Generally, in Maryland, any adult who is not disqualified by law may serve as an administrator. In most cases, if there are surviving spouses or relatives of the decedent, they will receive priority in being appointed as the administrator.

If no qualified family members exist to act as administrator, then a court-appointed fiduciary is used. Additionally, creditors and beneficiaries may also apply for appointment to administer the estate.

Ultimately, it is up to a judge's discretion to decide who should serve as the administrator based on their relationship to the deceased and ability to manage the estate properly.

Navigating the Maryland estate administration process can be complex, but understanding how to obtain letters of administration and how long it takes is an important part of the process. Obtaining letters of administration involves a petition to the Orphan's Court in the county where the decedent resided at the time of death.

In order to complete this step, an individual must be 18 years or older, have a valid Maryland address, and possess proof that they are related to the deceased in some capacity such as an heir or executor. The petitioner must also provide a copy of the will (if one exists) and any other documents requested by the court.

After filing a petition with the court, there is usually a hearing date scheduled within three months and then a decision is made as to who will receive letters of administration. Once granted, letters of administration can take up to two weeks for processing before they become effective.

It's important to note that even after obtaining this document, creditors may still present claims against any assets held by the estate unless those assets are protected by an exemption statute or trust agreement.

When navigating the Maryland estate administration process, it is important to understand what can be done with a Letter of Administration. A Letter of Administration is a legal document that grants an individual, known as the Personal Representative, authority to act on behalf of the estate.

The Personal Representative has the power to manage assets, collect debts and distribute assets according to state law and the wishes of the deceased. Additionally, Letters of Administration provide legal proof that the Personal Representative has been appointed and can be used in negotiations with banks, creditors and other entities associated with administering the estate.

In order to properly identify what can be done with Letters of Administration it is important for individuals to become familiar with state laws as well as any specific instructions noted in the Will or Trust documents.

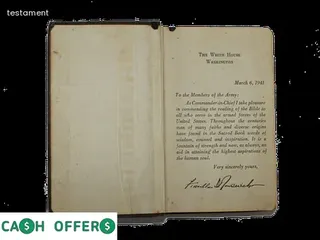

When navigating the Maryland estate administration process, it is essential to analyze key documents in order to properly administer an estate. This includes analyzing a will or trust, if available.

If the deceased passed without a will, then the administrator should look to any other written instructions that may have been left behind. It is also important to review any applicable power of attorney documents or health care directives that were put in place prior to death.

Furthermore, the administrator must investigate and analyze all financial accounts and assets owned by the decedent at the time of death. In addition, creditors should be identified and contact information for beneficiaries must be gathered in order to distribute any assets remaining after expenses are paid from the estate.

Finally, all tax-related obligations must be accounted for and satisfied before distribution of funds can take place. By carefully analyzing key documents during this process, one can ensure proper administration of an estate as dictated by Maryland law.

When navigating the Maryland estate administration process, it is important to be aware of any potential financial and tax implications that may arise. This comprehensive guide will provide helpful tips on how to ensure that all financial and tax issues are taken care of during the estate administration process.

It is recommended to understand the various taxes associated with a deceased person's estate, such as federal income tax, gift tax, and state inheritance or estate taxes. Additionally, any outstanding debts of the deceased must be paid off before distributing assets among beneficiaries.

Depending on the size of the estate and whether or not a will was created, it may also be necessary to review investments and accounts held by the deceased. Lastly, beneficiaries should consult a qualified accountant or other financial professional to ensure accurate reporting and timely payments of any applicable taxes.

When settling a decedent's will or trust, there are often legal challenges that need to be addressed. It is important to have a comprehensive understanding of the estate administration process in Maryland in order to navigate these legal issues.

This includes knowing the right people and agencies to contact, filing the necessary documents and paperwork, and understanding the laws governing probate, wills, executors, and trustees. Knowing which forms to file and when can save time, money, and frustration during what can already be an emotional process.

Being aware of potential pitfalls such as creditors' claims or disputes over gifts can help ensure that the estate is handled properly and any resulting taxes are minimized. Additionally, it is important to stay up-to-date with any changes in Maryland's estate administration laws that may arise during the settlement of the decedent's will or trust.

Navigating the Maryland estate administration process can be a complex and meticulous task. It is important to understand the potential post death changes that can occur with beneficiaries or assets, as this will help prepare the executor or administrator for any post death issues that may arise.

The first step in assessing post death changes is to review the deceased individual's will, if there is one, as it outlines who should receive specific assets after death. The executor should also check any applicable trusts and other documents associated with the estate, such as contracts and agreements.

If there are any discrepancies between these documents, they should be addressed with an experienced attorney as soon as possible. Additionally, if there have been changes to the deceased individual's financial situation since they created their will or trust, these changes should be documented and taken into account during the assessment process.

Lastly, contact must be made with all beneficiaries listed in the will or trust to ensure that they are aware of their rights under the estate and that all relevant documentation has been received by them. Assessing post death changes to beneficiaries or assets before beginning the Maryland estate administration process can save time and money for all involved parties.

Executors and administrators are two important roles when navigating the Maryland estate administration process. It is vital to understand the difference between the two and what their specific responsibilities are in order to properly manage an estate.

An executor is the person designated by a will to administer an estate, while an administrator is appointed by the court if there is no will or the executor named in a will isn’t able to act. Executors have primary responsibility for marshalling and managing assets, paying debts and taxes, filing necessary legal documents with various agencies, distributing assets as directed by a will, and even representing an estate in court proceedings.

An administrator’s duties are similar but may be limited in some cases due to court orders or restrictions placed on them. Both executors and administrators have certain duties that must be performed according to state law and failure to do so could result in legal action being taken against them.

Knowing these roles and their associated responsibilities can help ensure that all parties involved are fully aware of their obligations throughout the entire Maryland estate administration process.

Once you have applied for probate in Maryland, determining property distribution is the next step in the estate administration process. This includes gathering all necessary documents, filing an inventory of assets and liabilities, and obtaining court approval to distribute the estate.

It is important to understand that all creditors must be paid before distribution of remaining funds or assets can proceed. You must also ensure that any taxes due are paid before finalizing the probate proceedings.

The executor or administrator will then need to file a final report with the court and obtain a discharge letter releasing them from future liability. It is important to understand the laws and regulations governing the estate distribution process in Maryland, as well as any deadlines associated with completion of these steps.

Following these steps carefully ensures that your estate administration process runs smoothly and quickly so that you can move forward with distributing your loved one's assets according to their wishes.

In Maryland, the administrator of an estate is paid from the assets of the estate in accordance with a fee schedule set by the courts. Generally, a personal representative may charge up to five percent of the first $100,000 of gross value of the estate, three and one-half percent on the next $100,000, two and one-half percent on the next $800,000, two percent on the next $9 million and one percent on any amount above that.

The personal representative must provide a written accounting to all interested parties and receive court approval before any fees are paid. Furthermore, an additional fee may be required if extra services or time are needed beyond those normally required by an administrator's duties.

Ultimately, navigating Maryland's complex estate administration process requires careful consideration and planning to ensure that all parties involved are properly compensated for their services.

Navigating the Maryland estate administration process can be a daunting and confusing task, but understanding the timeline of the process is an important first step. Depending on the complexity of the estate and availability of required documents, getting a letter of administration in Maryland can take anywhere from weeks to months.

The letter of administration is issued by the Register of Wills office and serves as proof that you are authorized to administer an estate. In most cases, there will not be any delays if all paperwork is filed correctly, however if there are any disputes or complications with probate, it may take longer to receive the letter and begin administering the estate.

It's important to consult with an experienced attorney who understands Maryland's laws regarding probate when navigating this process as they can help you understand how long it may take for your case to be processed.

A letter of administration of estate in Maryland is a legal document issued by the court that grants an individual (known as the personal representative) the authority to manage and settle an estate on behalf of the estate’s beneficiaries.

The letter of administration allows the personal representative to open a bank account, pay debts and taxes, file income tax returns, distribute assets to beneficiaries, and perform other necessary tasks related to settling an estate.

This document is an essential part of navigating the Maryland estate administration process.

It is important for individuals who are appointed as personal representatives to understand their duties and responsibilities under this document in order to properly administer the estate in accordance with Maryland law.

When it comes to navigating the Maryland estate administration process, many people are unaware of the differences between an executor and an administrator of an estate. An executor is appointed by the deceased in their will before they pass away and is responsible for carrying out the instructions set forth in the will.

On the other hand, an administrator is appointed by a court if there is no valid will or if the executor is unable or unwilling to administer the estate. The administrator’s responsibility includes collecting assets, paying debts and taxes, and distributing any remaining assets to beneficiaries as determined by law.

It's important to understand that while both executors and administrators are responsible for completing similar tasks, they are appointed differently and have different duties depending on the situation.

A: In order to become an administrator of an estate in the State of Maryland, you must first submit a Last Will and Testament to a court for probate. Once probated, the court will appoint you as administrator and you will be responsible for managing, taxing, and distributing assets from the estate according to state laws and taxation regulations.

A: To become an Administrator of an Estate in Maryland, you must file a Petition for Probate with the Circuit Court where the decedent lived. You will also need to provide a bond, which is essentially insurance to cover any financial losses that may occur due to your actions as administrator. The court may also require you to present any codicils that may exist for the estate.

A: To become an administrator of an estate in Maryland, you must first petition the court for letters of administration and provide proof of your qualifications. Depending on the circumstances, the court may require a bond from a financial institution to protect against any potential losses. You must also show all trust documents, deeds and other titles that outline property interests, as well as prove you understand inheritance taxes in relation to estate administration.

A: To become an administrator of an estate in the State of Maryland, you must first file a petition with the local Orphans' Court. The petition must include a copy of the decedent's will (if any) as well as proof of death, a list of beneficiaries and creditors, and a receipt from the financial institution where funds are being held. You may be required to provide additional documents or information related to inheritance taxes depending on the size and complexity of the estate.

A: To become an administrator of an estate in Maryland, the interested party must prove that all debts and taxes have been paid. This includes inheritance taxes, which must be waived by a judge. Additionally, the interested party must provide proof that all necessary funds are held in trust with a financial institution or other approved authority.

A: In order to become a guardian of a child's estate in the State of Maryland, you must first complete an application and submit it to the court. You must also provide evidence that you are suitable for the role, such as proof of financial responsibility or letters of recommendation from those familiar with your character. Additionally, you must attend an orientation and training program approved by the court, and may be required to post security or bond.

A: To become an administrator of an estate in Maryland, you must provide proof of the market value of the estate, proof of your domicile (that is, where you are a legal resident), a certificate of title for all properties titled in the name of the decedent, and any other documents related to property owned by the decedent.

A: To become an administrator of an estate in the State of Maryland, you must first file a petition with the Register of Wills or Circuit Court in the county where the decedent was domiciled. The petition must include a copy of the decedent's will and death certificate, a list of all beneficiaries, and a statement regarding any statutory requirements. If required by law, you must also provide proof that notice has been mailed to all interested parties. Additionally, you may be asked to provide proof that appropriate insurance coverage is in place and documents related to market value, domicile, certificate of title and property titled.

A: In order to become an administrator of an estate in Maryland, you must file a petition with the circuit court in the county in which the decedent was domiciled. The petition must contain information about the decedent's assets, such as life insurance policies, and liabilities. You may also need to provide evidence of market value, domicile, certificate of title and property titled. It is important to check with your local jurisdiction to determine what other documents may be required.

A: In order to establish ownership of property in Maryland when claiming to be an administrator of an estate, siblings must provide proof of ownership by presenting a will or other legal document that names them as beneficiaries. If the deceased individual had a safe deposit box, it may contain documents verifying ownership. The claimants must also provide death certificates and proof of domicile to verify the deceased individual's residence at the time of their passing. Any documents related to market value, certificate of title, and property titled must also be presented. Lastly, any life insurance policies held by the deceased individual should be identified and provided upon request.

A: In order to become an administrator of an estate in Maryland, you must first understand the process of Intestate Succession and the Probate Process. You will also need to create an Inventory of Assets that includes all property, taxes and debts associated with the estate. Finally, you must meet any necessary insurance requirements and submit all relevant documents such as a Certificate of Title or Property Titled documents.

A: To become an Administrator of an Estate in Maryland, you must follow the Intestate Succession and Probate Process. This includes filing documents such as a Petition for Appointment of Personal Representative, preparing and submitting an Inventory of Assets and Payment of Debts and Taxes, obtaining necessary appraisals to determine market value, domicile, certificate of title and property titled. In addition, other insurance requirements may need to be met if life insurance policies are involved.

A: In order to become an administrator of an estate involving a will contest in Maryland, you must file a petition with the court in the county where the decedent resided. In the petition, you must provide proof of notice to all parties involved as well as any supporting documents. If the court approves your petition, you will be appointed as administrator and are responsible for managing and distributing assets according to the will or other applicable law.

A: To become an administrator of an estate in Maryland, you must first file a Petition for Probate with the Register of Wills in the county where the decedent was domiciled. The Petition will include information such as the decedent's name, date of death, and information about heirs and beneficiaries. Additionally, you will need to provide a copy of the decedent's death certificate and any needed documents to prove your relationship to the deceased (e.g., birth certificate). After filing, you must go through a process that includes taking an Oath of Office before a Notary Public, obtaining Surety Bond insurance coverage, listing all assets owned by the decedent at the time of death (inventory), notifying creditors, accounting for income and expenses incurred since the death, preparing tax returns if applicable, and distributing assets in accordance with the laws of inheritance.

A: To become an administrator of an estate in Maryland, you will need to provide the probate court with a list of the decedent's assets and liabilities, copies of any applicable death certificates, and copies of the last two years of the decedent's tax returns. You may also need to provide additional documents such as market value appraisals, domicile certificate of title, and property titled in order to complete the application process.

A: To become an administrator of an intestate or testate estate in Maryland, a person must petition the court to be appointed as the personal representative of the deceased's estate. This requires filing a petition for appointment with the Register of Wills in the county where the deceased resided at the time of death. The petition must include a copy of the decedent’s will (if any exists) and other supporting documents such as proof of death, proof of assets, and any applicable bond information. Afterward, if no objections are raised by creditors or other interested parties, a hearing may be held to determine whether or not to grant the appointment.

A: To become an administrator of an estate in Maryland, one must first be appointed by court order or by the last will and testament of the deceased. This appointment must be approved by the local Register of Wills. The appointed administrator is then responsible for locating, collecting and distributing all assets within the estate. This includes preparing an inventory of all assets, paying any outstanding debts and taxes from the estate's funds, and ultimately distributing the remaining funds according to the provisions set forth in a valid will or as determined by Maryland intestate law.