Social media can be a powerful tool for real estate professionals navigating the process of becoming an estate administrator in New Jersey. Understanding the benefits of leveraging social media to promote one's skills and services as an estate administrator is essential in today's digital age.

Platforms such as Facebook, Instagram, and Twitter present opportunities to reach larger audiences with minimal effort and cost. With the right strategy, real estate professionals can leverage these platforms to market their services and build a strong online reputation as an estate administrator.

Additionally, social media networks provide a platform for connecting with potential customers in a more personal way by sharing informative content such as blog posts or video tutorials. Social media can also help real estate professionals keep up-to-date on trends and news related to the field of estate administration in New Jersey.

By understanding how to use social media effectively, real estate professionals can maximize their chances of success when navigating the process of becoming an estate administrator in New Jersey.

Social media can be a crucial tool for estate administrators in New Jersey, as it provides an effective platform for connecting with potential clients and customers. For real estate professionals, understanding the best ways to leverage social networks like Facebook, Twitter and LinkedIn is essential for reaching out to prospects and building relationships.

Strategically using social media platforms can help you effectively target your audience and create multiple selling points. When creating content for your channels, focus on topics relevant to estate administration such as tax laws or probate procedures.

Utilizing visuals such as infographics or videos can also be beneficial in gaining exposure while reinforcing your message. Additionally, engaging with other industry professionals is a great way to expand your network and build awareness of your services.

With the right approach, social media can become a powerful tool in helping you grow as an estate administrator in New Jersey.

Navigating the subpages of an Estate Administration website can be daunting for Real Estate Professionals embarking on their journey to becoming an Estate Administrator in New Jersey. It is important to understand the steps that must be taken to ensure you are following all necessary procedures and understand the requirements needed to become a successful Estate Administrator.

Start by creating an account with the website, as this will grant you access to all of the subpages and forms associated with becoming an Estate Administrator. Once your account is created, familiarize yourself with the forms and documents that need to be filled out before submission.

Additionally, review all relevant state laws and regulations pertaining to Estate Administration. Utilizing these resources will help you gain a better understanding of what information is required and how to properly submit it according to state law.

Furthermore, it is important to plan ahead when submitting any documents or forms; read through each page thoroughly as some documents may require additional steps or signatures before they can be legally processed. Taking these extra precautions will ensure a smooth transition into becoming an Estate Administrator in New Jersey.

For those looking to become an estate administrator in New Jersey, there are a few things to consider before selecting the right one. First, investigate the individual's qualifications and experience in estate administration, as well as their knowledge of local laws and regulations.

It is also important to assess their ability to communicate effectively with family members and other stakeholders throughout the process. Furthermore, it is essential to review the fees associated with hiring an administrator, as this may impact overall costs associated with settling an estate.

In addition, make sure you understand the time frames associated with working with an administrator and what services they offer upfront versus those that are billed separately. Finally, ask for references from clients who have previously worked with them so you can get a better sense of how they operate and if they would be a good fit for your particular needs.

Navigating the process of becoming an estate administrator in New Jersey requires a few important steps. The first is to gain an understanding of the state laws and regulations, as well as any specific qualifications and credentials required for the particular role.

Next, formal notice must be given to any heirs or beneficiaries that the person intends to become an administrator. It is then necessary to obtain letters of administration from the county surrogate's office, which will provide a legal document certifying that the prospective administrator has been authorized by the court to carry out their duties.

Once this is complete, a bond must be filed with the surrogate's court along with additional paperwork that outlines all pertinent details related to the estate. Lastly, it is important to appoint qualified professionals such as attorneys and accountants who can assist in managing any tax issues associated with administering an estate.

Exploring the quick links on estate administration websites is an important step in navigating the process of becoming an estate administrator in New Jersey. These websites provide a wealth of information, from FAQs to forms and instructions for filing documents with the county clerk's office.

Additionally, they may provide links to other resources related to estate administration such as legal advice and financial planning services. Estate administrators should familiarize themselves with these websites and the available resources so that they can better understand the requirements for becoming an estate administrator in New Jersey.

Knowing which forms need to be filled out and where to find them is a key part of successfully completing the process of becoming an estate administrator. Furthermore, it is also important to be aware of any laws or regulations that may affect one's ability to fulfill their duties as an estate administrator.

Familiarizing oneself with these quick links can help make the process much easier and ensure that all documents are properly filed in order to become an estate administrator in New Jersey.

Navigating the process of becoming an estate administrator in New Jersey can be a complex undertaking for real estate professionals. Knowing where to look for the necessary information, resources and regulations specific to New Jersey is key in helping real estate professionals understand their roles and responsibilities.

To start, understanding the general laws and regulations governing estate administration in New Jersey is important. Estate administrators must also become familiar with state statutes covering probate proceedings, as well as applicable tax laws.

Additionally, they should be knowledgeable of relevant case law that may impact their work. It’s also important to research local court rules regarding the filing of documents, notices and other legal paperwork required by law.

Many online resources are available that provide access to administrative codes and court rules on these topics that are specific to New Jersey. Lastly, real estate professionals should consult their local bar association or other legal organizations for resources related to estate administration that may be beneficial in navigating the process of becoming an estate administrator in New Jersey.

Accessing members areas on estate administration sites is an important step for real estate professionals navigating the process of becoming an estate administrator in New Jersey. To get started, users must create an account with the relevant website and provide necessary information such as name, address, email address and contact number.

Once the account has been established, users can gain access to the members area of the website which typically includes a variety of resources such as forms related to estate administration, up-to-date legal documents, news and updates regarding changes in laws and regulations governing estates in New Jersey, and more. Furthermore, many websites offer additional features such as webinars on topics relevant to estate administration in New Jersey.

Taking advantage of these resources will give real estate professionals a better understanding of how to handle estate matters properly.

When optimizing a website for user experience, font resizers are an important feature to consider. By allowing visitors to easily adjust the size of text on a page, they can personalize their visit and better understand the content presented.

Adjusting fonts through resizing is especially beneficial for those with visual impairments or those who want to zoom in on particular sections of an article. It’s also important to remember that font resizing should be compatible with all devices; whether users are viewing the site on a desktop computer, tablet, or smartphone, they should have access to this feature as it helps enhance their overall experience.

Additionally, when selecting a font resizer, you should look for one that allows users to make both small and large adjustments. This way they can customize the material presented on the page without having to scroll up and down to view its entirety.

With these tips in mind, webmasters can create an effective site that meets the needs of their visitors when navigating the process of becoming an estate administrator in New Jersey for real estate professionals.

One of the most important considerations for any real estate professional in New Jersey is navigating the process of becoming an estate administrator. Professional estate administration services can provide a wealth of benefits to those taking on this role, including reducing time and effort involved, providing access to legal advice, and offering guidance throughout the process.

Investing in professional services can help ensure that all necessary paperwork and documentation is properly completed, making it easier to manage the estate’s assets. Professional services can also help with debt management, property distribution, tax filing support, and other tasks related to estate administration.

Additionally, experienced professionals can offer insight into potential complications or issues that may arise during the process and suggest solutions. Finally, having access to qualified experts provides peace of mind knowing that tasks are being handled correctly and efficiently while meeting all legal requirements.

In order to become an estate administrator in New Jersey, you must meet certain qualifications. First, you must be 18-years-old or older and a US citizen or permanent resident.

Additionally, you cannot have been convicted of a felony within the last 10 years. You also need to be able to provide evidence that you are of good moral character and can competently manage the estate.

To demonstrate this character, two people who are familiar with your work as a real estate professional need to provide sworn statements testifying that they believe you would be suitable as an administrator. Once these requirements are met, you will need to submit an application package including several documents such as proof of citizenship/residency, criminal background check results, and the aforementioned sworn statements.

After submitting the application package and paying the processing fee, the New Jersey court system will review your qualifications before granting approval or denying access to become an estate administrator.

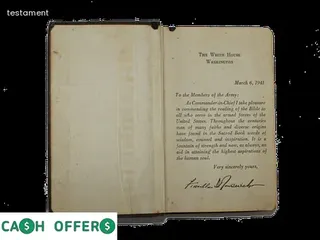

When navigating the process of becoming an estate administrator in New Jersey, real estate professionals must understand the legal responsibilities they will be held accountable for. This includes complying with state laws and regulations, as well as adhering to the terms of the deceased's last will and testament.

The administrator must also communicate effectively with all parties involved in order to ensure that the wishes of the deceased are carried out appropriately. Furthermore, administrators have a fiduciary duty to provide accurate information regarding tax and other financial matters related to the estate.

They must also properly manage any assets owned by the deceased, such as real estate or financial accounts, and distribute them according to their instructions. In addition, it is important for administrators to be aware of their obligations under relevant federal laws that may apply to certain transactions involving trust funds or other assets from the estate.

Finally, it is essential for an administrator in New Jersey to stay up-to-date on any changes in local or state laws that could potentially affect how they administer an estate.

When navigating the process of becoming an estate administrator in New Jersey, it is important to understand the tax implications associated with this role. New Jersey estate administrators must file an Inheritance Tax Return, which is due within eight months of the decedent's death.

Additionally, they must pay the appropriate inheritance taxes to the state before distributing any assets to beneficiaries. Furthermore, administrators are responsible for filing and paying other taxes such as federal income tax on any estate income.

They may also be responsible for filing and collecting sales tax for certain transactions that occur during the administration process. It is important for real estate professionals to be aware of these tax implications when considering taking on this role in order to ensure compliance with all applicable laws and regulations.

Preparing the necessary documents to become an estate administrator in New Jersey can be a daunting process. It is important to understand what documents are required and how they need to be submitted.

The first step is to obtain the Affidavit of Qualification for Appointment as Administrator from the Surrogate's Office of the county where the decedent resided at the time of death. This form must be completed and certified by a notary public.

Additionally, a Certified Death Certificate will be needed from the local health department. An Order of Appointment appointing a qualified individual as administrator must also be obtained from the Surrogate's Court, along with any letters of administration that may have been issued by the court.

Finally, a Resident Agent Form must be filled out and filed with either the New Jersey Secretary of State or a registered agent appointed by the court. By understanding all documents required for appointment and submitting them correctly, real estate professionals can successfully navigate through this process and become appointed as an estate administrator in New Jersey.

Navigating the process of becoming an estate administrator in New Jersey can be complicated due to the various regulations from both the federal and state governments. Federal laws provide the overall framework for estate administration, with some additional regulations coming from state governments.

It is important for real estate professionals looking to become estate administrators to understand what these regulations are and how they apply to their situation. For example, federal laws dictate who is eligible to serve as an executor or administer of an estate, as well as what types of actions they can take while overseeing the estate's affairs.

Additionally, different states may have their own statutes that outline other requirements such as filing deadlines or reporting procedures. Understanding these regulations can help ensure a smooth transition into becoming an estate administrator in New Jersey.

Social media is an invaluable tool for real estate professionals looking to navigate the process of becoming an estate administrator in New Jersey. With platforms like Facebook, Twitter, and LinkedIn, estate administrators can make connections with potential partners, stay informed on industry news and trends, and better advertise their services.

To make the most of social media platforms for estate administration purposes, it’s important to establish a presence by creating professional profiles and filling them with relevant content. When creating posts, be sure to use keywords that accurately reflect the services you provide so that your target audience can easily find them.

Engage with potential customers by responding promptly to comments and messages. Also consider utilizing paid advertising options such as sponsored posts or ads targeting specific demographic groups.

Lastly, start networking by joining relevant online groups or industry forums where other experienced professionals share advice and strategies for success in the field of estate administration.

In New Jersey, estate administrators have access to several resources to assist in the process of becoming a successful real estate professional. Many local organizations provide educational opportunities and workshops for those looking to pursue careers in this field.

Professional associations such as the New Jersey Bar Association offer networking opportunities and information about current laws and regulations related to estate administration. Additionally, many counties throughout the state have established advisory boards that offer guidance on legal issues, recordkeeping requirements, and resolution of disputes between parties involved in an estate.

Furthermore, several not-for-profit organizations are available to provide support services for those who need assistance with navigating the process of becoming an estate administrator. These services include providing advice on filing taxes on an estate, completing paperwork associated with probate court proceedings, and helping individuals understand their rights and responsibilities under New Jersey law.

It is essential for real estate professionals to create a comprehensive plan when navigating the process of becoming an estate administrator in New Jersey. This plan should include strategies for communicating effectively with beneficiaries during the estate administration process, as well as what steps to take after closing out the estate.

In order to ensure everyone involved is on the same page and knowledgeable about their roles and responsibilities, it is important to establish clear lines of communication early on. This includes setting expectations and providing regular updates throughout the process.

Additionally, having a system in place for tracking communications such as meeting notes, emails, and phone calls can help streamline the process and make sure no detail is missed. Once all documents have been reviewed and finalized, administrators should provide a written report summarizing the findings along with a list of any remaining tasks that must be completed before officially closing out the estate.

This helps ensure that all stakeholders are aware of their rights and obligations and can move forward with confidence.

To become an Administrator of an Estate in New Jersey, one must first meet certain qualifications and requirements. Real estate professionals who wish to serve as an administrator must be a resident of the state or have a place of business in New Jersey.

Additionally, they must be 18 years or older and be of sound mind and able to manage the estate’s affairs. They also have to provide proof that they are bonded for $50,000 in order to protect any assets that may be held by the estate.

Furthermore, applicants need to submit a statement affirming their appointment as an administrator along with two affidavits from respected citizens attesting to their fitness for the job. Once approved, an administrator is responsible for collecting all assets belonging to the estate, paying any outstanding debts or taxes owed, and distributing remaining funds among the heirs or beneficiaries according to the terms of the will.

With this guide in hand, real estate professionals can now confidently navigate through the process of becoming an Administrator of an Estate in New Jersey.

Becoming an estate administrator in New Jersey can be a complex process, especially when the estate does not have a will. Many real estate professionals may find the process of navigating this difficult terrain intimidating.

However, with careful planning and research, it is possible to successfully become an estate administrator without a will in NJ. The first step is to gather all relevant documents such as death certificates, tax returns, and bank statements.

These documents must be presented to the court in order to prove that the deceased person had no legal ties in the state. After collecting these documents, potential administrators must file for Letters of Administration (LOA) at their local county Surrogate’s Court.

Applicants must also submit a petition detailing their qualifications and reasons for wanting to become an administrator. Once approved by the court, applicants will be able to begin managing the probate process on behalf of the deceased’s estate.

With proper guidance and preparation, real estate professionals can successfully navigate this complex process and become an estate administrator without a will in NJ.

Administrator fees in an estate in New Jersey vary depending on the complexity of the estate. Generally, a basic fee is assessed for services such as filing documents and other administrative duties, but additional fees may be charged for more complicated tasks.

For example, if an estate includes real estate or business interests, additional fees may be charged to cover extra work associated with managing these assets. It is important for real estate professionals to understand these fees when navigating the process of becoming an estate administrator in New Jersey.

Knowing what the potential costs are ahead of time can help ensure that no surprises arise during the process. Additionally, understanding how much it costs to become an administrator can help real estate professionals determine whether they are able to take on this type of responsibility before committing to taking it on.

Yes, an Administrator of an estate does get paid in New Jersey. When navigating the process of becoming an Estate Administrator, it is important to understand the laws and regulations laid out by the state.

The State of New Jersey has specific rules for who can become an Estate Administrator, and how much they are allowed to be paid. In order to be eligible for appointment as an Estate Administrator in the state of New Jersey, individuals must meet certain requirements.

These include being a qualified executor or administrator appointed by a court, having no criminal history or outstanding judgments, and completing all legal paperwork associated with being appointed to administer the estate in question. Once these requirements are met and the individual is appointed as an Estate Administrator by a court-approved executor or administrator, they may be eligible to receive payment for their services.

Payment amounts vary depending on the size and complexity of the estate being administered. Real estate professionals interested in becoming an Estate Administrator should familiarize themselves with New Jersey’s laws regarding estate administration fees before beginning the process.