South Dakota inheritance tax laws govern how property is transferred after a person passes away. These laws are complex and depend on the size of the estate, the relationship between the decedent and the heirs, and a variety of other factors.

Understanding how to navigate South Dakota's inheritance tax laws can help ensure that property is passed on according to the wishes of the deceased. Generally speaking, when an individual dies in South Dakota, their estate must go through probate before any assets can be transferred to their heirs.

During probate, all debts and taxes must be paid off before anything is distributed to beneficiaries. In addition, any gifts or donations made during life may also be taken into account during probate.

South Dakota has an inheritance tax rate ranging from 1 percent to 15 percent depending on whether or not the heir is related to the decedent. For example, direct descendants and spouses pay no inheritance tax while more distant relatives are subject to higher taxes.

Spouses also have special rights when it comes to inheriting property in South Dakota; if there are surviving children from a previous marriage of either spouse, then both spouses need permission from those children to transfer any property upon death. Finally, individuals have the option of creating a will or trust that details how their property should be divided among their heirs upon death; however, these documents must comply with all applicable state laws in order for them to be valid.

When dealing with estate planning in South Dakota, it is important to understand the state’s laws regarding inheritance and property sale. Failing to properly calculate tax liabilities can lead to costly mistakes and create a financial burden on heirs.

South Dakota has specific rules for determining taxes owed on inherited property and proceeds from the sale of real estate. Generally, all taxes due must be paid before distribution of the estate’s assets begins.

It is important to be aware of both federal and state tax regulations when settling an estate in South Dakota. Property sold may be subject to capital gains tax, which must be calculated based on the value of the asset at purchase compared to its current market value.

Additionally, inheritance tax must also be accounted for when settling an estate. This includes any gifts or other transfers made prior to death.

A qualified attorney or certified public accountant should always be consulted when dealing with South Dakota inheritance law and calculating taxes owed by an estate.

When understanding the necessary filings for estate taxes in South Dakota, there are many rules and regulations that must be followed. It is important to understand the laws surrounding inheritance and property sale so that all documents can be completed correctly.

These laws can differ depending on the size of the estate, which may affect any taxes due from the sale of property or distribution of assets during an inheritance. As such, it is important to work with a legal professional who specializes in South Dakota estate laws.

This will ensure that all paperwork is properly filed and that any taxes owed will be accurately calculated according to state regulations. Additionally, a legal expert can provide advice on how to best protect your assets as well as provide guidance on how to divide them among heirs.

To avoid complications later on, it is essential to make sure all documents related to inheritance and property sale are properly filled out before being submitted.

When it comes to dying with a will in South Dakota, navigating probate processes can be difficult and confusing. It’s important to understand South Dakota laws on inheritance and property sale so you can ensure that your assets are distributed according to your wishes.

Generally, probate is the process that occurs after someone dies and includes validating the will, identifying and inventorying the deceased's assets, paying creditors, taxes and expenses from the estate, and distributing remaining assets according to state law. In South Dakota, if the decedent's estate is worth less than $100,000 then it does not have to go through formal probate court proceedings.

This can save time and money for those who are dealing with settling an estate. When it comes to inheritance laws in South Dakota, family members may receive different amounts depending on which type of inheritance they qualify for.

There are two categories: forced heirship or elective share provisions. Forced heirship requires that a certain portion of an estate must pass to specified family members such as spouses or minor children while elective share provisions give surviving spouses the right to receive a certain portion of the decedent’s estate.

In addition, there may be restrictions regarding selling property that was inherited in South Dakota since some states require heirs to obtain court approval before they can sell inherited real property or other assets. Therefore, it’s important for heirs in South Dakota to understand both their rights and responsibilities when it comes to inheriting property or selling real property that was inherited in order to ensure all legal requirements are met before any transactions take place.

In South Dakota, when a person dies without having made a valid will and testament, the laws of intestate succession apply. This means that the deceased's assets are distributed according to the state's laws.

Generally speaking, the estate of a deceased person is divided among their spouse, children, parents and siblings- if any of these exist. If none of these kin are present, then other more distant relatives may be eligible for inheritance according to South Dakota's laws.

In some cases where no relatives exist or can be found, the estate may be paid to the state itself. It is important to note that certain property such as real estate or business interests may require special handling in order to ensure that the terms of an intestate succession are properly carried out.

Additionally, individuals who wish to sell inherited property should familiarize themselves with South Dakota's regulations on such matters in order to reduce legal risks and maximize their profits.

In South Dakota, spousal rights play a large role in property inheritance and sales. Understanding the state's laws on property sale and inheritance is important for couples to ensure their rights are protected.

Generally, when a spouse passes away, the surviving spouse has the legal right to inherit all of the deceased spouse's personal property. This includes any real estate, personal belongings, and money that was owned by the deceased spouse at the time of death.

Furthermore, there are other legal protections for surviving spouses in South Dakota such as homestead rights and probate exemptions. Homestead rights allow a surviving spouse to remain on the deceased's property until they decide to sell it or until they remarry.

Additionally, probate exemptions give a surviving spouse certain assets without having to go through a lengthy probate process. These laws help protect the interests of both parties involved in an inheritance or property sale situation.

It is important for couples in South Dakota to be aware of these laws so that they can make informed decisions about their rights when dealing with an inheritance or sale of property.

When it comes to understanding inheritance rights of children in North and South Dakota, there are many aspects to consider. Both states have laws that govern the transfer of assets from a deceased parent or guardian to their offspring, including property sales and real estate transactions.

In South Dakota, the law states that children must be at least 18 years old before they can receive their inheritance. The law also provides for an exception if the minor is married; then they can receive their inheritance at any age.

North Dakota has different rules for minors receiving an inheritance; the law states that children must be at least 14 years old before they can receive any sort of property or real estate transaction. In both states, it is important to understand all of the rules and regulations surrounding how minors can receive inheritances, as these laws can change frequently and vary depending on the circumstances.

Additionally, it is important to understand what happens when a minor inherits money or other assets from a deceased family member or guardian; whether they will be able to keep them or not will depend on certain factors like age and relationship with the deceased. It's important for families to thoroughly research their state's laws on inheritance rights before making any decisions about how best to manage an inheritance or sale of property in order to ensure everyone gets their fair share.

When investigating inheritance rights of unmarried individuals without children in South Dakota, it is important to understand the state's laws on the subject. South Dakota's intestacy laws grant inheritance rights to a surviving spouse, and if none exists, then to a decedent’s nearest relatives.

Unmarried individuals without children are usually considered distant relatives and will have much more limited inheritances compared to those with closer ties. Furthermore, if the decedent did not have a will or other estate planning documents prior to their death, the court will be responsible for distributing assets according to the law.

It is also important to note that any property acquired during cohabitation may be subject to division upon dissolution of the relationship or death of one of the parties involved. Finally, it is important for unmarried individuals to consider creating an estate plan in order to ensure their wishes are respected after they pass away; such plans can help avoid potential legal disputes over real estate and other assets.

In South Dakota, non-probate inheritances are handled differently than probate inheritances. Non-probate inheritances refer to property that is passed directly to legal heirs without going through the probate process.

This type of inheritance is governed by South Dakota statutes and may include joint tenancy, life insurance or retirement accounts, or pay on death accounts. To understand the laws governing non-probate inheritances in South Dakota, it’s important to consider the specific criteria dictating how these assets are transferred.

For example, joint tenancy property is distributed according to the right of survivorship if two or more people own a piece of property together. On the other hand, life insurance policies will pass directly to any designated beneficiaries listed in the policy without having to go through probate court.

Finally, for retirement accounts and Pay on Death Accounts (POD), the funds contained within these accounts will be passed on to any designated beneficiaries at the time of death.

The laws governing inheritance and property sale vary greatly between North and South Dakota. In South Dakota, the transfer of real estate after death is governed by the South Dakota Codified Laws Title 25.

These laws include a variety of stipulations that must be taken into account when dealing with the transfer or sale of property and assets upon the death of a person. Additionally, there are other situations outside of inheritance law that should be considered when living in either North or South Dakota.

For instance, if you are married and live in North Dakota, both spouses must agree to the sale or transfer of any real estate owned by either one. Furthermore, if any disputes arise regarding the ownership or transfer of property, it is important to obtain legal advice from an experienced attorney familiar with state laws in both states.

Finally, if you are a resident of either state, it is recommended that you seek out legal advice prior to engaging in any transactions related to property and asset transfers following death.

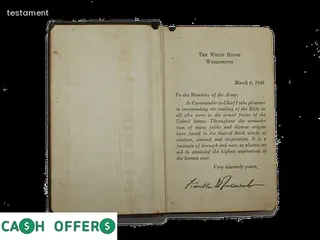

Living wills are an important document for estate planning purposes and can be beneficial in understanding South Dakota laws on inheritance and property sale. They serve as a way to ensure that a person's wishes are known and respected if they become unable to communicate them due to illness or injury.

Living wills provide instructions for medical treatment, designate an individual who will have authority to make decisions concerning medical treatments, and provide guidance on any other matters related to health care. In terms of South Dakota laws on inheritance and property sale, living wills can be used as a way to adhere to the state's guidelines regarding distributions of assets after death.

This includes providing direction on how assets should be transferred among heirs or beneficiaries. Moreover, living wills can also help inform family members about the deceased's wishes regarding funeral arrangements or burial services.

Ultimately, living wills are considered effective for estate planning because they provide clear instructions that are legally binding, allowing individuals to decide their own destiny in advance if they become incapacitated.

Understanding guardianship and conservatorship regulations related to estates in South Dakota is an important part of understanding laws on inheritance and property sale. Guardianship or conservatorship is when a court appoints someone to make decisions for a minor child or incapacitated adult, including decisions related to the estate.

This can be a difficult and stressful process, as the court must ensure that the guardian or conservator is responsible and qualified. In South Dakota, certain criteria must be met for someone to become a guardian or conservator, such as proof of residence, background checks, and financial stability.

The court may also require that guardians complete an orientation course in order to understand their legal duties and responsibilities. Additionally, they may be required to submit annual reports regarding the estate's finances and any other changes pertaining to its management.

Ultimately, understanding these regulations can help ensure that South Dakotans are informed about their rights when it comes to inheritance and property sale laws in the state.

When examining health care consent laws for estates in North and South Dakota, it is important to understand the distinction between the two states. In South Dakota, only a court-appointed conservator or guardian can provide consent for medical treatment of an incapacitated person.

Furthermore, a spouse may give consent on behalf of their partner when they are unable to do so. With regards to inheritance and property sale laws, South Dakota requires that the decedent’s will be authenticated by either two witnesses or a notary public.

This includes any subsequent changes made to the will. On the other hand, North Dakota does not require authentication for wills but does require that all personal property must pass through probate court before it can be sold or distributed.

Additionally, North Dakota also allows individuals to select an agent to make medical decisions on their behalf without going through a court procedure if they become incapacitated. Ultimately, understanding the differences between these two states’ laws helps ensure that estate plans are properly administered and that important decisions are made with respect to medical care and inheritance.

Understanding the durable power of attorney regulations for estates in North and South Dakota can be a challenging task. It is important to be aware of the differences between these two states, as inheritance laws may vary significantly between them.

In particular, South Dakota has a number of unique regulations regarding inheritance planning and transfer of property through sale. For example, South Dakota law requires that any buyer purchasing personal property must receive written consent from all heirs if the seller is deceased.

Additionally, if real estate is involved in an estate transaction, then more complex rules apply such as title searches and notifications to family members. While this may seem complex at first glance, understanding the rules governing durable power of attorney regulations for estates in both North and South Dakota can help ensure that your loved one's assets are properly managed after their passing.

Assessing estate planning strategies for minimizing taxes in North and South Dakota is an important consideration for anyone who owns property in either state. Tax rules regarding inheritance and property sale can vary significantly from one state to another, so it is important to understand the laws applicable to each state before making any decisions.

In South Dakota, inheritance tax is not levied on estates; instead, there are a range of gift taxes that may be applied depending on the size of the transfer and the relationship between the donor and recipient. When it comes to selling a property, capital gains taxes are applicable if the seller made a profit from the sale; however, certain exemptions are available depending on individual circumstances.

Taking these into account when formulating an estate plan can help ensure that any taxes due are minimized as much as possible.

Exploring regulations in North and South Dakota regarding heir property often involves understanding the laws of inheritance and the sale of property. South Dakota has a unique set of rules that govern how estate planning is handled, including how to transfer real estate after someone passes away.

Heirs may have certain rights to the deceased's property, such as a right to receive an inheritance or a right of first refusal on real estate. Depending on the size and value of the estate, taxes may also apply in some cases.

In addition, special considerations must be taken into account when selling property from an estate, including who holds title to the land and who is responsible for any remaining debts or mortgages associated with it. It's important for heirs to familiarize themselves with all relevant laws in order to ensure that their inheritance is properly managed and that any sale of real estate is conducted according to legal requirements.

When it comes to estate taxes, there are differences in regulations between North Dakota and South Dakota. In South Dakota, the state does not impose an estate tax at the time of death.

Instead, the federal government levies an estate tax that applies to estates over a certain value. In North Dakota, however, both the state and federal governments levy estate taxes based on different levels of property values.

This means that individuals in North Dakota may face a higher overall estate tax bill than those in South Dakota. It is important for residents of both states to understand their respective laws when it comes to inheritance rights and property sale regulations related to estate taxes.

Knowing how these laws differ can help ensure that inheritors are not hit with unexpected costs due to taxation or other legal issues.

When researching potential exemptions from state estate taxes in North and South Dakota, it is essential to understand the laws of both states. It is important to note that exemptions may vary state-by-state.

In South Dakota, inheritance and property sale laws can impact estate tax exemptions. According to South Dakota law, inheritance tax is imposed on transfers of real or personal property that are made by gift or at death; this tax rate may range from 1% to 18%.

Additionally, if an individual owns real property located in South Dakota at the time of death, an inheritor must pay a transfer fee upon sale of the property. This fee may be up to 2% of the sale price and is owed within sixty days after the transfer.

To qualify for exemption from estate taxes in either North or South Dakota, individuals should consult with a qualified tax professional about their specific circumstances.

Creating a trust for passing assets to beneficiaries in North and South Dakota can provide many benefits, such as avoiding probate court and protecting assets from creditors. In South Dakota, a revocable living trust is the most common type of trust used for asset protection or estate planning.

The creator of the trust, known as the Grantor, can act as Trustee while they are alive and designate someone else to assume control upon their death. This allows the Grantor to keep control over their assets while they are still alive, while also ensuring that their beneficiaries receive them in a timely manner after they pass away.

By setting up a trust in South Dakota, it is possible to avoid certain taxes on inheritance and property sale that may otherwise apply. Additionally, this type of trust can help keep valuable information about your personal finances private since trusts do not have to be filed with public records.

Establishing a trust in North or South Dakota is an important step for those who want to ensure that their beneficiaries will receive their assets without any hassle when they pass away.

The Federal Tax Cuts and Jobs Act of 2017 brought substantial changes to the way estate planning is handled in both North and South Dakota. As a result, individuals considering inheritance or property sales in these states should understand the impact of the new law on their estate plan.

For example, the act places a limit on how much one can deduct from their taxable income when it comes to state and local taxes, which could affect an individual's ability to capitalize on deductions related to inheritance or property sales. In addition, the act includes provisions that increase the amount of money an individual can pass onto their heirs without incurring federal taxes.

Understanding these changes is essential for anyone who wishes to ensure that as much wealth as possible is passed down through generations. It is also important for individuals considering inheritance or property sale in North and South Dakota to be aware of any state laws that may affect their estate plan, such as South Dakota's Uniform Trust Code or rules regarding the transfer of real estate upon death.

In South Dakota, inheritance law is governed by the state's probate code. Generally, when someone passes away in South Dakota, their assets will be subject to a probate process.

The probate process involves the distribution of assets according to the deceased individual's will or, if there is none, according to the intestacy laws of South Dakota. With respect to inheritance, if there is no will, then South Dakota law establishes who is entitled to inherit the deceased person’s property.

In general, any surviving spouse or children are entitled to an intestate share of the estate; if there are no surviving spouse or children then other relatives such as parents and siblings may be entitled to inherit some portion of the estate. Additionally, South Dakota has specific laws that govern how property may be sold after an individual passes away.

These laws outline procedures for transferring title and also specify conditions under which a sale may be completed without court approval or approval from other family members. Understanding these laws can help ensure that estate matters are handled properly when dealing with inheritance issues in South Dakota.

In South Dakota, the answer to whether an estate must go through probate is generally yes. Probate is a process in which the court oversees the distribution of assets from a deceased person’s estate.

Probate ensures that creditors are paid, taxes are settled and any remaining assets are distributed according to the terms of a will or other legal document or as prescribed by state law. In South Dakota, if there is no will or other legal document specifying how assets should be distributed after death, the state's intestacy laws dictate who receives what share of the estate.

The probate process in South Dakota may involve filing documents with the court and having heirs appear for hearings before a judge makes a final decision regarding asset distribution. To streamline proceedings and expedite inheritance payments, South Dakota law allows certain estates to bypass probate if they meet specific criteria.

Before selling property or transferring an estate out of state, it’s important to understand South Dakota laws on inheritance and property sale so you can ensure you follow all applicable rules and regulations.

No, South Dakota does not have an estate or inheritance tax. In South Dakota, the estate tax is abolished and there is no inheritance tax.

Instead, the state has a transfer tax that applies to real estate transfers for consideration of $500 or more. The transfer tax is paid by the seller and is calculated at 2% of the consideration paid for the transfer.

This means that when property or real estate is sold in South Dakota, 2% of the sale price goes towards the state's transfer tax. There are certain exemptions to this law; however, they are few and far between.

For example, transfers between spouses are exempt from this tax. To understand more about South Dakota laws on inheritance and property sale, it's important to speak with an experienced attorney who can provide detailed advice on your specific situation.

In South Dakota, intestate succession is the process by which a person's assets are distributed if they die without a valid will. According to South Dakota law, the surviving spouse is entitled to the first $100,000 of their estate and one-half of any remaining assets.

If there is no surviving spouse, then the estate is divided between the deceased's children at the time of death, or if there are none, then to their nearest living relative. In cases where neither a surviving spouse nor relatives can be found, the state takes ownership of any assets that remain.

It's important to note that in South Dakota, any property owned jointly with a surviving spouse or designated beneficiary will pass according to contract law rather than through intestate succession.

A: Yes, heir property can be sold in South Dakota if it is held in trust as part of the estate of someone who has died. However, it is recommended that you consult a probate lawyer to ensure that all legal requirements are met and any necessary probate law documents are filed.

A: Yes, heir property can be sold in South Dakota if it is held in trust as part of a testamentary estate that is overseen by a guardian, with the help of a lawyer.

A: Yes, an Executor of Intestate Property in the State of South Dakota is able to sell the property.

A: Yes, heirs can sell heir property held under any of these arrangements in South Dakota. The Executor of the estate of a deceased person may also have the authority to sell the property on behalf of the heirs.

A: Yes, Tenants in Common are able to sell heir property in South Dakota.

A: Yes, inherited IRAs, life insurance policies, and other assets subject to federal estate tax can be sold in South Dakota. However, the sale must comply with applicable state and federal laws governing the transfer of ownership.

A: Yes, loans on heir property can be sold in South Dakota. The executor of the estate may need to obtain permission from a court to do so, however.

A: No. In South Dakota, a Testator cannot use their Taxpayer Identification Number, Tax Identification Number, or Social Security Number to sell heir property. The Executor of Intestate Property and Joint Tenants with Right of Survivorship, Tenancy in Common, or Joint Tenants can sell heir property in South Dakota, but the sale must be done through the courts. Inherited IRAs, life insurance policies, or other assets subject to federal estate tax may also be sold in South Dakota; however this must also be done through the courts.

A: No, inflation does not affect the liability of an heir to sell property in South Dakota. However, Iowa law may impose additional liabilities depending on the circumstances.

A: Yes, a beneficiary of a pension or retirement savings account can sell the property in South Dakota. However, they should seek professional financial advice to ensure that any tax implications are taken into consideration before making the sale.

A: Yes, a beneficiary may sell their share of an inheritance in South Dakota as long as they comply with the state's laws regarding the sale of heir property.

A: Yes, under South Dakota laws, heirs are able to sell property that has been inherited, provided all of the necessary legal steps are followed.

A: Yes, heirs of a deceased person may sell their inherited property in South Dakota even if the surviving spouse is still alive. However, it is important to note that state laws and regulations may apply.