Understanding the probate process in Tennessee is an essential step in becoming an estate administrator. This process begins when a will is submitted to the court to begin the administration of a deceased person's estate.

The court system is responsible for determining if the will is valid, identifying and notifying beneficiaries, collecting and managing assets, paying off any debts or taxes owed, and distributing remaining assets to the appropriate heirs. Before any of this can be done, however, an executor must be appointed (or named in the will) to manage the estate.

The executor is typically a trusted family member or close friend that has been entrusted with making sure all assets are properly managed and distributed as intended according to state laws. The court may also appoint an administrator if there was no valid will in place or if there were no named executors.

In either case, it’s important for those wishing to become estate administrators to have a thorough understanding of Tennessee's probate laws in order to ensure everything is handled appropriately and efficiently.

In Tennessee, probate is required for distributing a deceased person's estate if the value of the assets is greater than $50,000. The process involves identifying and collecting the assets and paying off any bills or taxes before distributing the remaining property to beneficiaries.

In some cases, an estate administrator will be appointed to oversee the distribution of assets. Probate can be a lengthy process that can be costly and time-consuming, so it is important to understand what alternatives are available.

A living trust is one option that allows the deceased person's wishes to be carried out without going through probate court. Property may also be transferred before death through gifts or joint ownership with right of survivorship.

If there are no disputes between beneficiaries, an informal settlement agreement may also be used in lieu of probate court proceedings. Knowing when probate is required and understanding available alternatives can help make the estate administration process more efficient and cost-effective in Tennessee.

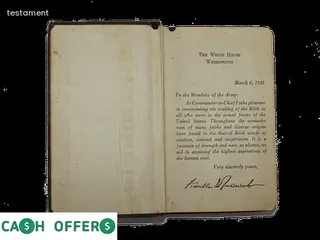

When it comes to becoming an estate administrator in Tennessee, one of the most important tasks is identifying a valid will for the estate. In order to do this, it is essential to understand the laws and regulations surrounding the process in Tennessee.

First, you must determine if there is a valid will that has been filed within three years of the decedent's death. If so, then a copy of the will must be obtained from either the court or from any other source where it may have been filed.

Additionally, you should also look for any codicils or other amendments that may exist that could affect how assets are distributed among beneficiaries. Once a valid will is identified, then it must be filed with the court and approved by a judge before it can be enforced.

Becoming familiar with Tennessee's probate laws and regulations regarding wills is essential when embarking on this part of becoming an estate administrator in Tennessee.

The role of a probate attorney in Tennessee is essential when it comes to becoming an estate administrator. They can provide guidance on which tasks must be completed during the probate process, as well as assist with filing the necessary paperwork and documents required by the state.

In addition, they can advise on how to properly and legally handle estate assets, debts and other related matters. Probate attorneys may also be called upon to represent the interests of the beneficiaries or creditors of the estate.

Lastly, they can help ensure that all legal requirements are met in order for a decedent's final wishes to be carried out correctly and efficiently. As such, it is important for anyone considering becoming an estate administrator in Tennessee to seek counsel from a qualified probate attorney so that their rights are protected and their responsibilities are fulfilled according to state law.

When investigating creditors in an estate, the administrator must take into account all claims against the estate and notify them accordingly. This includes researching publicly available information, such as court records and credit reports, to find any potential creditors.

Once a creditor is identified, the administrator should reach out to them in accordance with Tennessee state law to inform them of the estate. This could involve sending written notices or other forms of communication, depending on the circumstances and requirements of the case.

It is important that all creditors are notified accurately and in a timely manner so that they can make their claims against the estate if necessary. The administrator should also make sure that all details pertaining to each creditor are thoroughly documented for future reference.

Becoming an estate administrator in Tennessee is not a simple task. It requires gathering assets, obtaining relevant documents and understanding the laws surrounding estates in Tennessee.

To begin the process of becoming an estate administrator, it is important to collect all of the financial documents related to the estate. This includes bank statements, investment accounts and any other documents that can provide insight into the value of the estate.

Additionally, the administrator will need to collect personal property owned by the deceased such as cars or furniture that are part of the estate. Furthermore, it may be necessary to obtain relevant documents such as proof of citizenship or marriage certificates.

Depending on what type of assets are included in the estate, additional information may be needed like titles for real estate properties or life insurance policies. Once all necessary documentation is gathered for evaluation, an attorney should be consulted for advice about navigating legal issues associated with estates in Tennessee before filing with a court.

Filing tax returns on behalf of an estate is a key responsibility for an Estate Administrator in Tennessee. As such, it is critical to understand the various forms and documents that must be completed and filed with the Internal Revenue Service (IRS).

The Estate Administrator must ensure that all appropriate information is provided to the IRS, including income earned by the estate and any deductions or credits available. Furthermore, proper documentation must be maintained to prove that the estate has met all filing requirements.

In addition to federal taxes, state taxes may also need to be filed with the Tennessee Department of Revenue. Understanding each tax form and any applicable deadlines is important for successfully fulfilling this role as an Estate Administrator.

When addressing claims against an estate in Tennessee, it is important to take into account the applicable state law and any relevant federal laws. It is also essential that the estate administrator understand their responsibilities when dealing with creditors and claimants, including how to document and evaluate debt or claims against the estate.

They must also be aware of any deadlines they are subject to in order to ensure that all parties are treated fairly. Additionally, estate administrators should be familiar with the tax implications of settling a claim as well as any other legal obligations associated with such transactions.

Furthermore, it is important for administrators to consider any potential risks associated with dealing with claims in order to protect the interests of all involved parties. By understanding these responsibilities and adhering to all applicable regulations, an estate administrator can successfully navigate the process of addressing claims against an estate in Tennessee.

The task of distributing assets to beneficiaries according to the will is a crucial part of estate administration. In Tennessee, the court must approve the will before any distribution can occur.

As an estate administrator in Tennessee, you must be familiar with all state laws and regulations regarding wills and probate. The process of asset distribution can be complex and time-consuming, so it’s important to understand the necessary steps involved.

You must begin by verifying that all assets are accounted for and properly documented, followed by determining the date of death market value for each asset. You should also ensure that all heirs are accurately identified and that proper notices are sent to any creditors or other interested parties.

Once these steps have been completed, you may begin distributing assets in accordance with the provisions of the will. If there are any disputes among beneficiaries or creditors during this process, you should contact a qualified attorney who is knowledgeable about estate law in Tennessee.

Once all the assets have been distributed and the estate is in its final stages, there are still a few steps to take to ensure that everything is finalized.

Estate administrators in Tennessee must make sure all debts and taxes have been paid, file any necessary court documents, contact creditors for a final accounting of any outstanding payments, obtain a discharge from personal liability from the court, and provide an accounting of all assets distributed from the estate to any interested parties.

This can be an arduous process that requires attention to detail and knowledge of state laws; however, with careful planning and preparation it is possible for administrators to successfully complete the task.

When considering estate planning, some individuals may wonder if they need both a will and a trust. A will is often thought of as the most basic component of an estate plan and it allows someone to designate who will receive their possessions after they die.

However, a trust can provide additional benefits to those that choose to include both documents in their estate plan. A trust enables the assets to be managed by a chosen individual (or trustee) and can offer greater protection from creditors or other claims against the assets than what is offered with just a will alone.

In addition, many types of trusts also enable the assets to be passed on without having to go through probate court proceedings which can save time and money for those involved. Ultimately, it is important for individuals in Tennessee looking to become an estate administrator to understand the differences between wills and trusts and how they can best be used together when creating an estate plan.

Becoming an estate administrator in Tennessee is a complex process that requires dedication and attention to detail. Knowing the steps involved in becoming an administrator of an estate can help you navigate this process with ease.

First, it is important to understand the relevant laws regarding estate administration in Tennessee. Before you can be approved as an administrator, you must apply for a license from the Department of Commerce and Insurance or the County Clerk depending on where you live.

Once your application has been approved, you must meet any additional requirements set forth by the court or probate office. These may include filing certain documents and keeping detailed records of all transactions related to the estate.

Additionally, you will also need to create an inventory of assets belonging to the estate, manage finances and taxes associated with it, and distribute assets according to instructions given in the will or trust agreement. Finally, if there are disagreements among beneficiaries regarding how assets should be handled or distributed, it is up to you as the administrator of the estate to resolve them in accordance with state laws.

Becoming an estate administrator in Tennessee requires dedication and knowledge of relevant laws and regulations; however, understanding these processes can make obtaining your license much smoother.

When dealing with small estates, it is important to understand the concept of probate and how to avoid it. Probate is the legal process of settling a deceased person’s estate, which can be lengthy and expensive.

Simplifying the estate can help avoid probate by reducing any potential debt or taxes that may need to be paid. In Tennessee, if an estate is valued under $50,000, certain procedures are available to simplify and streamline the process.

Also in Tennessee, those who wish to become an estate administrator must complete a few steps including filing documents with the court in order to obtain Letters of Administration. Once appointed by the court, estate administrators will be responsible for managing the deceased person’s assets, paying debts and distributing any remaining funds or property according to their wishes.

It is important to note that all states have different laws and regulations when it comes to managing estates so understanding what specific requirements must be met in Tennessee is vital for those looking to become an Estate Administrator there.

If there is no valid will in place when an estate needs to be administered, it can become a complicated process for the administrator. Tennessee law determines how an estate without a valid will is handled; these laws are known as the laws of intestacy.

Intestacy laws give priority to certain family members regarding the distribution of assets from the estate. If the deceased person has no surviving relatives, then the assets will pass to the state.

The administrator must establish who is entitled to receive assets and arrange for them to be paid out accordingly. The administrator also needs to collect any outstanding debts due to the estate and ensure that all taxes are paid before distributing any assets.

It is essential that an estate administrator fully understands Tennessee's intestacy laws and procedures before undertaking this task, as they must adhere strictly to them throughout the process.

The probate process in Tennessee can vary greatly depending on the complexity of the estate. Generally, however, it takes anywhere from three to six months to complete probate in Tennessee.

The length of time is affected by many factors such as the number of assets in the estate, the size of the estate, and any disputes that may arise. It is important for an estate administrator to be aware of all these factors so they can be prepared for a longer timeline if needed.

Furthermore, understanding all applicable laws and regulations will help ensure a smooth and timely probate process. In addition to having an understanding of the law, estate administrators should also familiarize themselves with filing deadlines set by the courts in order to avoid delays or other legal issues.

Taking time to understand these processes ahead of time can help make sure everything runs smoothly and efficiently during probate.

Becoming an estate administrator in Tennessee is a complex task, but with the right guidance and resources it is possible to do so. One of the key components of this process is determining appropriate fees for executors or trustees.

This is an important step because it sets the parameters for what will be expected of those overseeing the estate. When setting these fees, there are several factors to consider such as the size of the estate, complexity of tasks required and amount of time needed to complete them.

Additionally, Tennessee state law outlines certain legal requirements that must be met when calculating executor or trustee fees. It is important to become familiar with these laws before setting any fees as they will help ensure proper payment while protecting all involved parties.

Lastly, executors and trustees should also take into account any taxes applicable to their services when determining appropriate fees for their work.

The probate process can be both time consuming and expensive. It is important to take steps to minimize costs during this often complicated legal process.

One of the most effective methods is to create an estate plan ahead of time that clearly outlines the wishes of the deceased. Having a comprehensive estate plan in place will help ensure that the executor or administrator of the estate understands how to best handle any assets, debts, and other matters related to the deceased's estate.

Additionally, it is important to research any applicable laws and regulations in Tennessee related to probate before beginning the process as these may provide additional cost savings opportunities. Communicating regularly with family members and other involved parties can help keep misunderstandings from turning into costly disputes or delays in getting through the probate process.

Finally, knowing when to seek professional assistance from an experienced attorney or accountant can save time and money by ensuring all necessary documents are filed correctly and on time.

In Tennessee, the deceased person's property is generally accessible to the estate administrator. It is their responsibility to collect, secure and manage all assets in accordance with the law.

Under Tennessee law, creditors of the deceased may have access to the estate and its assets so that they may receive payment for debts owed by the deceased. Beneficiaries listed in a will also have access to assets within an estate as they are typically entitled to receive a share of the inheritance.

In addition, any real property such as land and buildings belonging to the deceased may be given over to a surviving spouse or other family members according to state law. Lastly, if there is no will or beneficiaries listed in a will, then certain assets such as cash or investments can be distributed among legally recognized heirs under state laws of descent and distribution.

The probate process of dividing up the estate of a deceased person can be fraught with disagreements and disputes over how to distribute the property. It is important for an estate administrator in Tennessee to understand their role in resolving such disputes between heirs or other beneficiaries.

Estate administrators should be familiar with the legal requirements for distributing assets, and have a good understanding of Tennessee state law regarding inheritance. They should also have experience at mediating disputes between parties, as well as being able to provide counseling and support to family members who are grieving the loss of a loved one.

An effective estate administrator will be able to work with all involved parties to reach an agreement that is fair and equitable for everyone involved, while ensuring that the terms of the will are properly followed.

Navigating complex issues in Tennessee's intestate succession laws can be daunting, but estate administrators must be familiar with them. It is important to understand the terminology used when discussing the laws and to thoroughly research the subject before taking on an estate administrator role.

Estate administrators should have a working knowledge of all of Tennessee's inheritance laws, including understanding who is eligible to receive an inheritance, what type of property is included in an estate, and any applicable tax obligations that may exist. They must also be aware of any special circumstances that could affect the distribution of assets such as disabilities or legal incapacities.

Lastly, it is important for estate administrators to know how to apply these laws correctly and ensure that they are properly followed and enforced. With the proper understanding and preparation, anyone can become an estate administrator in Tennessee by following this comprehensive guide.

In Tennessee, a person can be an administrator of an estate if they are at least 18 years of age and are a resident of the state. Additionally, any person who is related to the deceased by blood or marriage may qualify as an estate administrator in Tennessee.

Moreover, a court may appoint an unrelated third party such as a lawyer or accountant to be the administrator of an estate if necessary. It is important to note that in certain circumstances, such as when there are multiple heirs or creditors involved, the court will choose the individual most qualified for the job.

To become an estate administrator in Tennessee, it is important to understand the process and filing requirements outlined by state law. Following these steps can ensure that the appointed administrator has all legal authority over assets that were left behind by the deceased.

In Tennessee, an administrator of an estate can earn a competitive salary depending on their experience and qualifications. According to the Bureau of Labor Statistics, the average annual wage for a Tennessee estate administrator was $58,750 as of May 2017.

Salaries for experienced administrators typically range from $45,000 to $75,000. The median annual salary for all legal professions in Tennessee was $63,030 in 2016, higher than the national average of $56,910.

Additionally, most states require estate administrators to obtain a license or certification before they can practice law. Licensing requirements vary by state but generally include completing an accredited program and passing a licensing exam.

These licensing fees are often paid by the estates themselves and may be reimbursed by employers upon completion of the exam.

In order to become an estate administrator in Tennessee, you must first obtain a letter of administration from the local probate court. To receive a letter of administration, you must first file a petition with the local probate court.

The petition should include information about the deceased and their assets, as well as your relationship to the deceased and why you are seeking to be appointed administrator of the estate. Once you have filed your petition, the court will hold a hearing where they will review all relevant details surrounding the estate and make a ruling on who should be appointed administrator.

If they decide that you are qualified to administer the estate, they will issue you a letter of administration. This document is essential for becoming an estate administrator in Tennessee, as it gives you legal authority over the affairs of the estate.

The duties of an estate administrator in Tennessee may vary depending on the size and complexity of the estate. Generally, however, they are responsible for collecting and managing all assets related to the estate, including real property, bank accounts, investments and other financial assets.

They must also pay any outstanding debts, income or inheritance taxes and distribute any remaining assets according to the wishes of the deceased. An administrator of an estate in Tennessee must also prepare financial statements and file any necessary tax returns.

Additionally, they may be required to provide court filings such as final accountings, inventories and appraisals. An important responsibility of an administrator is to notify creditors that their claims must be presented within a certain period of time or be barred from recovery against the estate.

Finally, administrators are responsible for protecting the interests of beneficiaries by ensuring that all estate-related matters are handled properly.

A: To become administrator of an estate in Tennessee when the deceased died without a will, you must go through the probate process. You will need to file a petition with the local probate court and appear before the probate judge who may appoint you as administrator of the estate. The court will determine whether or not testamentary provisions are necessary.

A: In Tennessee, if a decedent dies without a will and has children, then the surviving spouse or any of the decedent's children may petition to be appointed as estate administrator. The court generally prefers that either the surviving spouse or adult child serve as administrator.

A: If the deceased died without a will, you can file a petition to be appointed as the Administrator of their estate in the Probate Court of the county where they resided. This petition must be signed by you and filed with the court along with applicable fees. The paperwork must then be served on all interested parties via First Class Mail to their last known address or to an address designated for service by them. In Davidson County (Nashville), all petitions are mailed to P.O. Box 196303, Nashville TN 37219-6303.

A: If the deceased died without a will in Tennessee, you can fill out an application to be named administrator of the estate. The application must include the name and address of the decedent, as well as any heirs or creditors. You must also provide copies of death certificates and other relevant documents. Once all of the required paperwork is completed and submitted, you may need to notify interested parties by mail or email.

A: To become administrator of an estate in Tennessee, you must contact your local probate court and provide proof of the decedent's death. Additionally, you must provide a copy of the decedent's driver's license, birth certificate, Social Security Card, and any other documents that can be used to prove identity. You can find your local probate court by searching online using your zip code or by calling the court directly and leaving a voicemail.

A: In Tennessee, if a person dies without leaving a will and did not file Income Tax Returns or Federal Estate Tax returns, their surviving siblings may petition the court for letters of administration. The petitioner must provide proof of the decedent's death, proof of residency in Tennessee, proof of citizenship, and evidence of financial securities that support their petition. They must also provide a reason why they should be appointed administrator.

A: To become the administrator of an estate in Tennessee if the deceased did not leave a will or file Penitentiary, Income Tax Returns, or Federal Estate Tax returns you must first file a petition with the appropriate court. The petition must include evidence that proves that no will exists and that you are qualified to serve as administrator. Once this is done, the court may grant Letters Testamentary which gives you authority to manage the estate. You must also send notice to all heirs or beneficiaries listed in the petition. Additionally, you should communicate your appointed status to any relevant parties such as banks and creditors through messages and other marketing materials.

A: The first step is to petition the court to appoint someone as administrator of the estate. This can be done through filing a Petition for Letters of Administration with the probate court in the county where the deceased resided. After being appointed, the administrator must fulfill all fiduciary duties required by law, such as publishing notices and collecting funds from financial institutions. The administrator should also research online resources for information on how to handle income tax and federal estate tax filings.

A: To become an administrator of an estate in Tennessee, you must research Tennessee Estate Administration laws, complete any necessary education and training, gain experience in the field, and then apply for an estate administrator position.

A: To become an administrator of an estate in Tennessee, you will need to research the state's estate laws and understand your role as an administrator. You should also gain experience in estate administration, as well as complete any necessary education requirements. Additionally, if the deceased died without a will or did not file Income Tax Returns or Federal Estate Tax returns, you must meet the statutory requirements for administrators of estates in Tennessee.